Services Offered

Comprehensive Financial Planning • Investment management • Retirement planning

Asset allocation • 401k, 457, 403b rollovers • IRA accounts

Insurance review • Beneficiary review • Charitable gifting strategies

Tax free/tax deferred investments • Titling of assets review • Budgeting/Cashflow planning

Fees

How we are paid depends on the type of advisory service we are performing. Please review the fee and compensation information below. Typically fees are paid quarterly and some are negotiable (at the firms discretion), inquire for details.

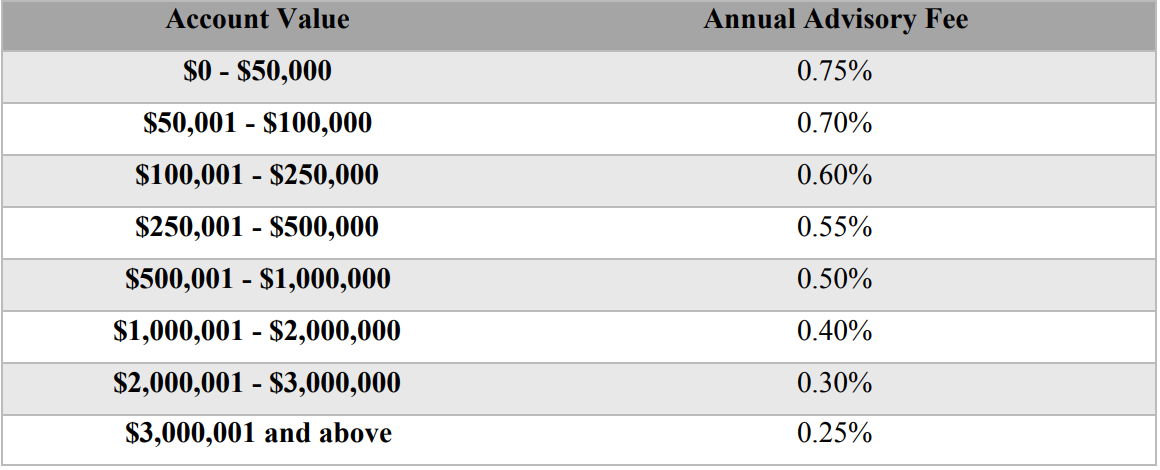

Investment Management Services

Our standard advisory fee is based on the market value of the assets under management and is calculated as follows - see chart.

The annual fees are negotiable depending on account size, prior history with investment adviser representative, relationship to investment adviser representative, and services provided. Annual fees are prorated and paid in arrears on a quarterly basis. The advisory fee is a blended fee and is calculated by assessing the percentage rates using the predefined levels of assets as shown in the above chart and applying the fee to the account market value as of the last day of the previous quarter. For example, a client with an account market value of $100,000 would pay a blended fee of $50,000 x 0.75% for $375 plus $50,000 x 0.70% for $350 for a total fee of $725. No increase in the annual fee shall be effective without agreement from the Client by signing a new agreement or amendment to their current advisory agreement.

Advisory fees are directly debited from Client accounts, or the Client may choose to pay by check. Accounts initiated or terminated during a calendar quarter will be charged a prorated fee based on the amount of time remaining in the billing period. An account may be terminated with written notice at least 30 calendar days in advance. Since fees are paid in arrears, no refund will be needed upon termination of the account.

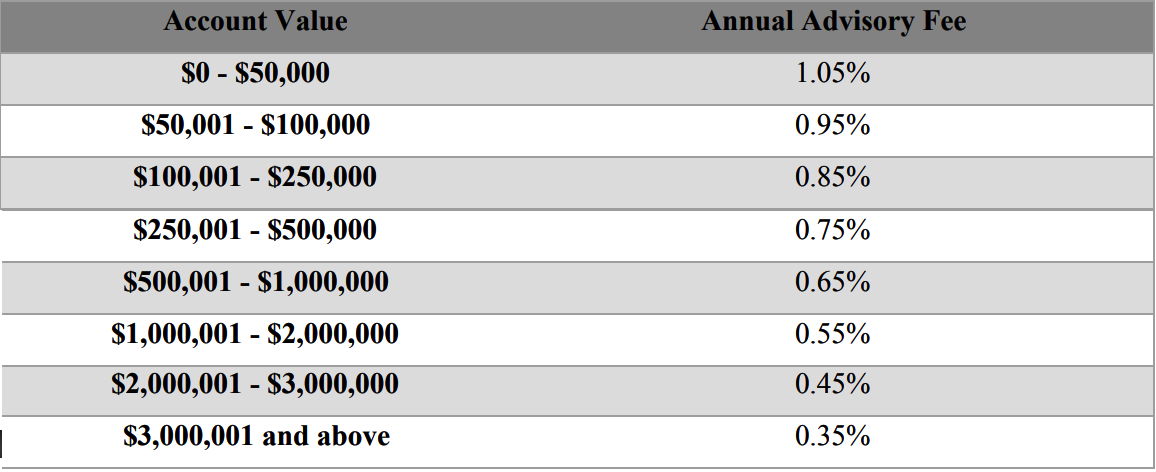

Investment Management and Ongoing Comprehensive Financial Planning

Our standard advisory fee for this combined service is based on the market value of the assets under management and is calculated according to the adjacent chart.

The annual fees are negotiable depending on account size, prior history with investment adviser representative, relationship to investment adviser representative, and services provided. Annual fees are prorated and paid in arrears on a quarterly basis. The advisory fee is a blended fee and is calculated by assessing the percentage rates using the predefined levels of assets as shown in the above chart and applying the fee to the account market value as of the last day of the previous quarter. For example, a client with an account market value of $100,000 would pay a blended fee of $50,000 x 1.05% for $525 plus $50,000 x 0.95% for $475 for a total fee of $1,000. No increase in the annual fee shall be effective without agreement from the Client by signing a new agreement or amendment to their current advisory agreement.

Advisory fees are directly debited from Client accounts, or the Client may choose to pay by check. Accounts initiated or terminated during a calendar quarter will be charged a prorated fee based on the amount of time remaining in the billing period. An account may be terminated with written notice at least 30 calendar days in advance. Since fees are paid in arrears, no refund will be needed upon termination of the account.

Project-Based Hourly Financial Planning Fixed Fee

Project-Based Financial Planning is offered at a rate of $200 per hour. The fee is negotiable depending on account size, prior history with investment adviser representative, relationship to investment adviser representative, and services provided and is due at the completion of the engagement. In the event of early termination by the Client, any fees for the hours already worked will be due. Fees for this service may be paid by electronic funds transfer or check.

Ongoing Financial Planning

Ongoing Financial Planning consists of an upfront charge of $1,000 and an ongoing fee that is paid quarterly, in arrears, at the rate of $200 - $400 per quarter. The fee is negotiable depending on account size, prior history with investment adviser representative, relationship to investment adviser representative, and services provided. Fees for this service may be paid by electronic funds transfer or check. This service may be terminated with 30 days’ notice. Upon termination of any agreement, the fee will be prorated and any unearned fee will be refunded to the Client.

The upfront portion of the Comprehensive Financial Planning fee is for Client onboarding, data gathering, and setting the basis for the financial plan. This work will commence immediately after the fee is paid, and will be completed within the first 30 days of the date the fee is paid. Therefore, the upfront portion of the fee will not be paid more than 6 months in advance.

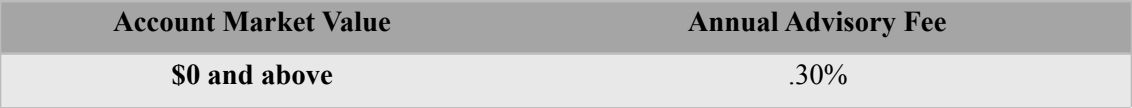

Custodian Services

Custodial Services consist of access to a personal advisor, trade settlement, quarterly statements, custody and safekeeping of assets, online access to account, and IRA Requirement Minimum Distribution calculations. The annual fees are negotiable depending on account size, prior history with investment adviser representative, relationship to investment adviser representative, and services provided. Annual fees are prorated and paid in arrears on a quarterly basis. The advisory fee is a flat fee and is calculated by assessing the percentage rate using the predefined levels of assets as shown in the above chart and applying the fee to the account market value as of the last day of the previous quarter. No increase in the annual fee shall be effective without agreement from the Client by signing a new agreement or amendment to their current advisory agreement.

Advisory fees are directly debited from Client accounts, or the Client may choose to pay by check. Accounts initiated or terminated during a calendar quarter will be charged a prorated fee based on the amount of time remaining in the billing period. An account may be terminated with written notice at least 30 calendar days in advance. Since fees are paid in arrears, no refund will be needed upon termination of the account.

Employee Benefit Plan Services

PlanVest LLC will be compensated in arrears for Employee Benefit Plan services according to the account market value of plan assets not to exceed .45% of total plan assets. The advisory fee is a flat fee and is calculated by assessing the percentage rate using the predefined levels of assets as shown in the above chart and applying the fee to the account market value as of the last day of the previous quarter. No increase in the annual fee shall be effective without agreement from the Client by signing a new agreement or amendment to their current advisory agreement.

This does not include fees to other parties, such as RecordKeepers, Custodians, or Third-Party-Administrators. Fees for this service are either paid directly by the plan sponsor or deducted directly from the plan assets by the Custodian on a quarterly basis, and PlanVest LLC’s fee is remitted to PlanVest LLC.

Additional Fees and Expenses

As part of our investment advisory services to you, we may invest, or recommend that you invest, in mutual funds and exchange traded funds. The fees that you pay to our firm for investment advisory services are separate and distinct from the fees and expenses charged by mutual funds or exchange traded funds (described in each fund's prospectus) to their shareholders. These fees will generally include a management fee and other fund expenses. You will also incur transaction charges and/or brokerage fees when purchasing or selling securities. These charges and fees are typically imposed by the broker-dealer or custodian through whom your account transactions are executed. We do not share in any portion of the brokerage fees/transaction charges imposed by the broker-dealer or custodian. To fully understand the total cost you will incur, you should review all the fees charged by mutual funds, exchange traded funds, our firm, and others. For information on our brokerage practices, refer to the Brokerage Practices section of this brochure.

We do not accept compensation for the sale of securities or other investment products including asset-based sales charges or service fees from the sale of mutual funds.