Services Offered

Comprehensive Financial Planning • Investment management • Retirement planning

Asset allocation • 401k, 457, 403b rollovers • IRA accounts

Insurance review • Beneficiary review • Charitable gifting strategies

Tax free/tax deferred investments • Titling of assets review • Budgeting/Cashflow planning

Fees

How we are paid depends on the type of advisory service we are performing. Please review the fee and compensation information below. Typically fees are paid quarterly and some are negotiable (at the firms discretion), inquire for details.

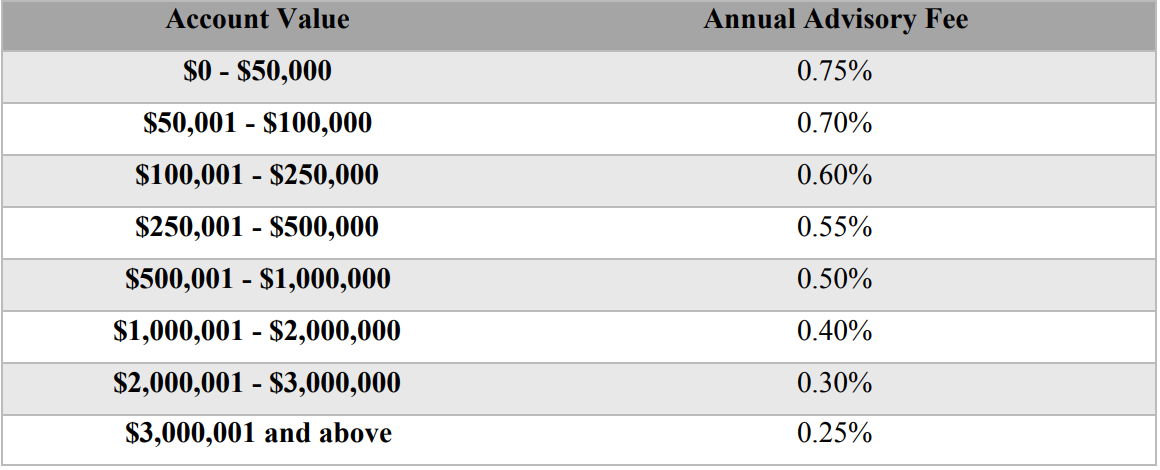

Investment Management Services

Our standard advisory fee is based on the market value of the assets under management and is calculated as follows - see chart.

The advisory fee is a blended fee and is calculated by assessing the percentage rates using the predefined levels of assets as shown in the following chart and applying the fee to the account market value as of the last day of the previous quarter.

For example, a client with an account market value of $100,000 would pay a blended fee of $50,000 x 0.75% for $375 plus $50,000 x 0.70% for $350 for a total fee of $725.

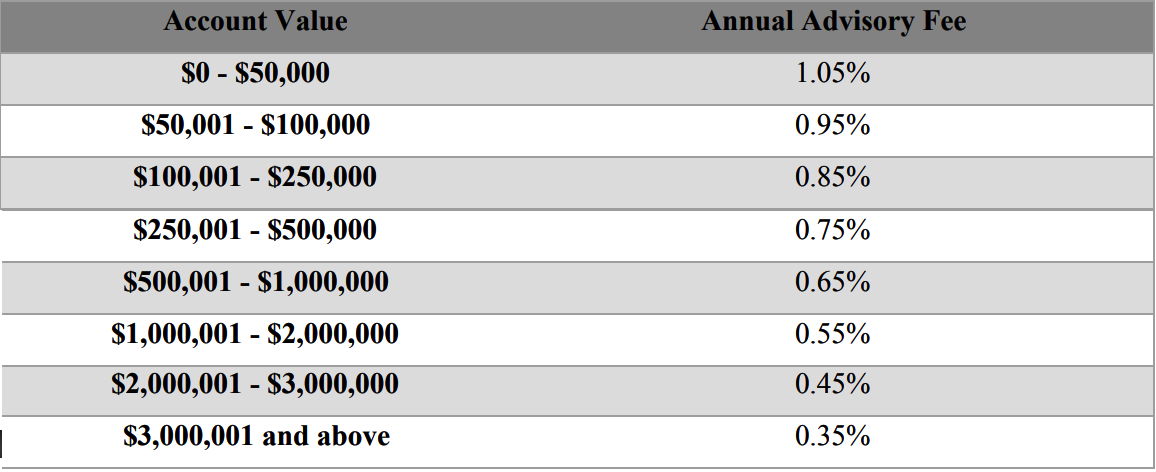

Investment Management and Ongoing Comprehensive Financial Planning

Our standard advisory fee for this combined service is based on the market value of the assets under management and is calculated according to the adjacent chart.

The advisory fee is a blended fee and is calculated by assessing the percentage rates using the predefined levels of assets as shown in the adjacent chart and applying the fee to the account market value as of the last day of the previous quarter.

For example, a client with an account market value of $100,000 would pay a blended fee of $50,000 x 1.05% for $525 plus $50,000 x 0.95% for $475 for a total fee of $1,000.

Project-Based Hourly Financial Planning Fixed Fee

Project-Based Financial Planning is offered at a rate of $200 per hour, paid at the completion of each engagement.

Ongoing Financial Planning

Ongoing Financial Planning consists of an upfront charge of $1,000 and an ongoing fee that is paid quarterly, in arrears, at the rate of $200 - $400 per quarter. Fees for this service may be paid by electronic funds transfer or check. This service may be terminated with 30 days’ notice. Upon termination of any agreement, the fee will be prorated and any unearned fee will be refunded to the Client.

The upfront portion of the Comprehensive Financial Planning fee is for Client onboarding, data gathering, and setting the basis for the financial plan. This work will commence immediately after the fee is paid, and will be completed within the first 30 days of the date the fee is paid. Therefore, the upfront portion of the fee will not be paid more than 6 months in advance.

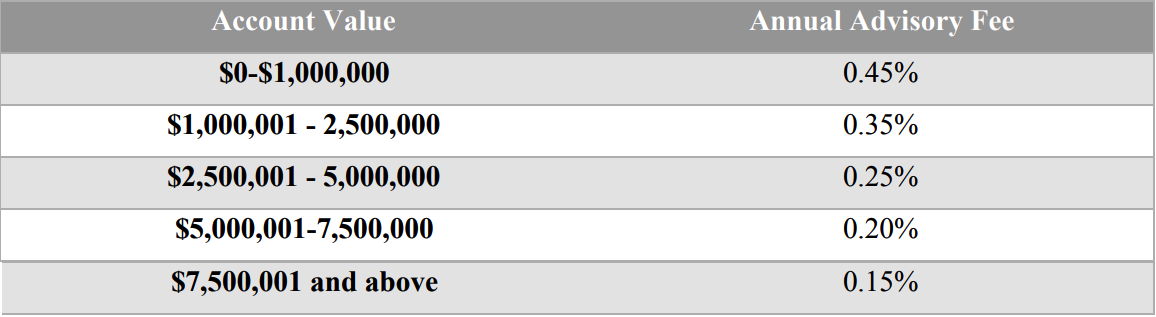

Employee Benefit Plan Services

PlanVest LLC will be compensated for Employee Benefit Plan services according to the value of plan assets not to exceed .45% of total plan assets.

This does not include fees to other parties, such as RecordKeepers, Custodians, or Third-Party-Administrators. Fees for this service are either paid directly by the plan sponsor or deducted directly from the plan assets by the Custodian on a quarterly basis, and PlanVest LLC’s fee is remitted to PlanVest LLC.

Other Types of Fees and Expenses

Our fees are inclusive of brokerage commissions, transaction fees, and other related costs and expenses which may be incurred by the Client. There may be additional fees incurred, and you as our client would be informed prior to any additional charges be acquired.